Smart Approaches for Getting Funding: Using the Perks of a Hard Money Lender

Smart Approaches for Getting Funding: Using the Perks of a Hard Money Lender

Blog Article

Opening the Tricks to Picking the Best Tough Cash Loan Provider

In the world of monetary decisions, picking a tough cash lending institution is an essential option that can considerably affect your financial investment undertakings. By meticulously navigating the standards that define a suitable hard cash lender, you can unlock the tricks that lead to a rewarding partnership and move your investment objectives ahead.

Variables to Take Into Consideration When Reviewing Lenders

Some difficult money lenders specialize in specific kinds of fundings, such as fix-and-flip homes or industrial genuine estate. By extensively evaluating these variables, you can select a tough money loan provider that aligns with your requirements and maximizes the success of your investment ventures.

Recognizing Car Loan Conditions

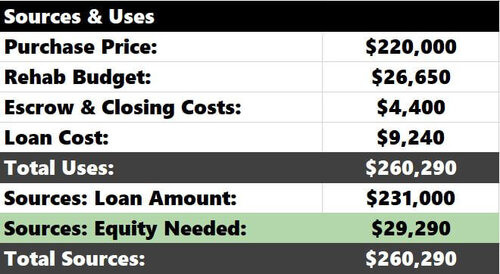

To obtain a thorough understanding of the finance terms and conditions offered by tough cash lending institutions, complete evaluation of the agreement is critical. The loan-to-value (LTV) ratio establishes the maximum amount the lender is ready to provide based on the residential property's value; it usually differs from 50% to 70%. Some tough money lenders enforce prepayment fines if you pay off the finance before a certain duration, so it's vital to clarify this element prior to signing the arrangement.

Tips for Contrasting Rate Of Interest

A thorough contrast of rates of interest amongst various hard cash lending institutions is necessary for making a notified borrowing choice. When reviewing rate of interest rates, it's important to look beyond the numbers provided and take into consideration the general expense of the financing. One crucial pointer for contrasting rates of interest is to focus on both the small price and the yearly percent price (APR) The small rate represents the standard rate of interest charged on the car loan quantity, while the APR gives a much more thorough view by integrating added costs and costs. By contrasting the APRs of different lending institutions, consumers can get a clearer photo of the total cost of borrowing.

Assessing Loan Provider Online Reputation and Trustworthiness

In reviewing potential difficult cash loan providers, one need to meticulously check out the reputation and reliability of each establishment to make an educated decision on selecting the finest lending institution for their financial demands. A loan provider's track record can offer useful understandings right into their track record, consumer fulfillment degrees, and total dependability.

Trustworthiness is an additional essential her comment is here factor to think about when analyzing hard cash lenders. Look for loan providers that are transparent concerning their terms, charges, and borrowing practices.

Browsing the Finance Application Refine

In addition, customers should be prepared to review their departure strategy for settling the finance. Hard cash lending institutions are primarily interested in the value of the security and the consumer's capacity to pay back the lending, so having a well-balanced exit strategy can enhance the application.

Throughout the application process, consumers ought to additionally ask about any kind of extra fees, the timeline for authorization, and the regards to the car loan. Understanding all facets of the car loan arrangement is important to make an educated choice and avoid any kind of surprises in the future.

Final Thought

To conclude, picking the most effective difficult money loan provider includes cautious factor to next consider of aspects such as financing terms, passion rates, online reputation, and the application procedure. By recognizing these key facets and carrying out thorough research study, debtors can make informed choices to safeguard one of the most appropriate funding for their demands. It is necessary to focus on openness, credibility, and compatibility with the loan provider to ensure a valuable and effective loaning experience.

To gain an extensive understanding of the financing terms and conditions offered by tough money loan providers, comprehensive assessment of the agreement is crucial. Recognizing just how interest rates can influence the total cost of the financing is crucial for selecting the finest hard money loan provider for your monetary requirements.

In examining potential hard cash loan providers, one have to thoroughly explore the reputation and trustworthiness of each institution to make an educated choice on picking the ideal loan provider for their financial requirements.Upon commencing the financing application procedure with a difficult cash loan provider, possible debtors should meticulously prepare their economic paperwork to facilitate a smooth and effective assessment of their car loan request.In final thought, selecting the finest hard cash lending institution includes careful factor to consider of elements such as car loan terms, check here rate of interest prices, credibility, and the application procedure.

Report this page